Objectives

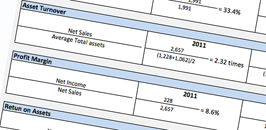

Through executive education courses at Northwestern University, the ICPAS Center for Corporate Financial Leadership and customized finance and accounting training for numerous corporations and nonprofit organizations, Powers shares her strategies for asking the right questions about financial statements and internal financial reports. Further, based on her co-authored research on the financial characteristics of High Performance Companies, she imparts a keen understanding of the 6 key financial statement numbers and the 4 essential ratios tied to value creation. This research led to the development of the Financial Performance Scorecard, an analysis tool, useful for summarizing the performance of a company, division, customer, supplier or competitor.

For individuals with little or no accounting knowledge or understanding of financial statements, Marian co-developed an interactive multimedia learning experience called Introduction to Financial Accounting. Using the Financial Consequences Model® developed for non-financial executives, one learns how financial statements are created.

Executive Education

Kellogg Executive Education Programs are designed for senior executives looking for cross-functional leadership development. Whether preparing to assume a general management role or seeking to enhance your strategic and decision-making capabilities, Kellogg programs aim to help you make an immediate impact.

For 2013 Marian is scheduled to teach in the following courses:

Kellogg Open Enrollment Programs

Executive Development Program June 15 - July 3, 2014 October 5 - 24, 2014 General management program that prepares executives with at least ten years of experience to assume general management responsibilities and become more effective leaders and change agents. You will learn leadership skills to manage at the interface of key functions and will be able to use strategic thinking to establish appropriate goals and get results.

Finance for Executives May 4 - 9, 2014 October 12 - 17, 2014 Whether you are new to finance or just want to sharpen your skills, this course will improve your ability to interpret financial reports and speak credibly to the financials of your organization. Senior faculty create a collaborative learning environment where you delve into concepts in order to better understand and predict the financial implications of managerial decisions. The program provides a comprehensive view of shareholder value creation and the key role managers play in the process.

Women's Director Development Program November 12 - 14, 2014

Discover the keys to unlocking the boardroom doors in this program for senior-level women executives. Understanding how boards work and the demands on directors is imperative for executives who serve or who aspire to serve on boards. During this unique and rigorous program, you will interact with experienced board directors and senior faculty as you explore the roles of boards, ways to structure boards for high performance, and strategies for maximizing your effectiveness as a board member. You will improve your current job effectiveness and your future director prospects while learning how to make the leap onto nominating committee radar screens.

Nonprofit Finance February 18 -20, 2014

This program will help senior executives improve their understanding of the entire financial picture of their organization. Participants will have the opportunity to better understand their financial statements, to spot financial trends, to identify areas of cost containment and to predict the implications of their management decisions.

Center for Corporate Financial Leadership

The Center for Corporate Financial Leadership is a partnership of state CPA societies and is dedicated to meeting the needs of corporate finance professionals through high-quality executive education, knowledge resources and networking communities. CCFL Executive Education is custom designed specifically to strengthen the business skills of corporate finance professionals and enable them to bring value to their company.

Marian teaches three executive education courses for the Center for Corporate Financial Leadership.

Financial Statements are Your Roadmap to Better Business Decisions: Creating Value for Your Company

Thursday, May 30, 2013

Are you using your company's financial statements to drive better business decisions?

Are you measuring the right things to drive success?

Discover how you can enhance your role as a strategic business partner to help your company drive better business decision through effective design, analysis, and communication of financial statements.

Through an experiential approach with real-world examples, you will focus on the critical measures that drive business results, sharpen your analytical skills and discover strategies to maximize value creation and minimize value destruction. You are also invited to bring in actual, hypothetical, or competitor financial statements and discover how you can use financial statements to make better business decisions.

8 hours CPE

Astute Cash Flow Management: Improving Company Value

What are some practical operational approaches to enhancing company valuation?

What diagnostic tools aid assessment of the strengths and weaknesses of cash flow management?

Through hands-on experimental cases, real world examples and small group activities, you will reexamine the link between company valuation and operating working capital, revenue growth, capital expenditures, outsourcing and more. In the process, various strategies used by high performing companies to maximize cash flows and consequently company valuation will be identified.

Bring your company's financial statements and plan to make some keen assessments to help your company go to the next level in creating firm value.

8 hours CPE

IFRS for SMEs: Private Companies take a Closer Look

Are you ready for 'Little GAAP'?

The International Financial Reporting Standard for Small and Medium-sized Entities is an acceptable GAAP for U.S. small and medium-sized entities companies with no public accountability.

Do you know if it's a good choice for your non-public company or one of your clients? What has been the current U.S. response to this new standard?

Learn how short and simple this new standard is and thoughtfully consider the multifaceted implications of adoption. Consider how different this standard might be as we take a closer look at how 'IFRS for SMEs' compares with current U.S. GAAP.

4 hours CPE

Introduction to Financial Accounting: The language of business

Whether you're a beginner at accounting or just need a refresher, this product will help you understand fundamental accounting concepts and how they are applied in business situations. The program puts you in the driver's seat as you record a series of business transactions, get tutored by your "coach" and receive evaluation of your work.

Here's the setting. Your friend, Bob, has managed to land you the job as accountant for a new startup venture. You actually take part as the accountant. Video clips, accounting glossary, 'frequently asked questions' list, the Financial Consequences® Model, all serve to help you successfully complete the program. Allow 1-2 hours to complete.

The Financial Consequences® Model is unique and provides users with a practical, intuitive approach for recording business transactions. It demonstrates how business decisions affect a firm's financial position and how the three financial statements interrelate. The model is included in this interactive multimedia software program and may be launched as an Excel spreadsheet for customized use by selecting 'Financial Consequences® Model' from the menu bar. The option is only available after you complete the 10 to-do items in the Introduction to Financial Accounting.

For questions regarding the Introduction to Financial Accounting click here.

To login and access the downloadable version with your access code click here.

To order a downloadable version of the Introduction to Financial Accounting click the button below.

High Performance Research

With the first research study published in 2002, we launched a series of studies investigating the financial characteristics of high performing companies in most industries except insurance and financial services. The research, which is published in referred journals, is written with an academic audience in mind, but the results have implications useful to executives. Marian often incorporates these implications in her Kellogg executive education courses, CCFL courses and customized corporate programs.

Operating Characteristics Of High Performance Companies: Strategic Direction for Management, 2014

Financial Characteristics Of High Performance Companies in Australia, 2010

Corporate Governance in India: Issues and Practices of High-Performance Companies, 2009

Financial Performance Scorecard

The Financial Performance Scorecard 2.0 (FPS) is a financial analysis tool developed from more than 10 years experience researching the financial characteristics of high performance companies for the period of 1989 through 2010. More than 20,000 companies were studied over this period.

Each FPS starts with an analysis of the 6 key numbers and 4 key ratios that provide insight as to whether a firm has created value for its owners.

- A 4-year trend analysis

- Graphic and numerical reporting

- Multi-step template for analysis of income statement

- Short version focuses on 4 key ratios and the related performance measures and one template for multistep income analysis.

- Service firm version includes everything in short version plus analysis of accounts receivables

- Full version includes everything in short version plus cash conversion cycle ratios and a second template for multistep income analysis.

To learn more about the research related to High Performance Companies click here.

To order any version Financial Performance Scorecard 2.0 or get more information click here.

Corporate Clients

Since 1987, Marian has designed and delivered customized finance and accounting training for numerous corporations and organizations. She specializes in teaching managers and executives the strategies for asking the right questions about the financial statements with a focus on how to determine if firms or one of their subsidiaries or divisions are creating or destroying value.

Whatever the objectives are for the training/learning experience, her approach is highly interactive and with immediate application. Past program participants possess a wide range of expertise and functional experience from a broad range of industries. Some clients include:

- Accenture, Inc

- Allstate Corporation

- Ameritech Corporation (AT&T)

- AON Financial Services

- American Association of Pediatric Dentists

- American Orthopedic Association

- Baxter International

- Beam Global (Fortune Brands)

- CDW Corporation

- Chicago Cubs

- Citadel Investments

- Cristo Rey

- Edwards Life Sciences

- GATX

- GE Railcar, Inc.

- Hearst Corporation

- Hospira

- IMC Global

- Illinois Agricultural Leadership Foundation

- Illinois CPA Society

- Indiana CPA Society

- Kimberly Clark Corporation

- Knight-Ridder Corporation

- Lake Forest Graduate School of Management

- Lucille Packard Children's Hospital

- Material Sciences Corporation

- Maynard Institute

- McKinsey & Company

- Menttium 100

- Mercer

- Minnesota CPA Society

- Monitor Liability

- National Association of Broadcasters Educational Foundation

- Nike Corporation

- North Dakota CPA Society

- Opera America

- P.H. Glatfelder, Inc.

- Quebecor World

- Rabobank

- Regulatory Affairs Professionals Society

- Société Générale

- TAP Pharmaceutical

- United States Olympic Committee

- Women's Foodservices Forum

- Zurich Insurance